|

1 registered members (SBGuy),

712

guests, and 3

spiders. |

|

Key:

Admin,

Global Mod,

Mod

|

|

|

The7 strategy

#408401

The7 strategy

#408401

09/30/12 16:04

09/30/12 16:04

|

Joined: Jul 2000

Posts: 27,978

Frankfurt

jcl

OP

OP

Chief Engineer

|

OP

OP

Chief Engineer

Joined: Jul 2000

Posts: 27,978

Frankfurt

|

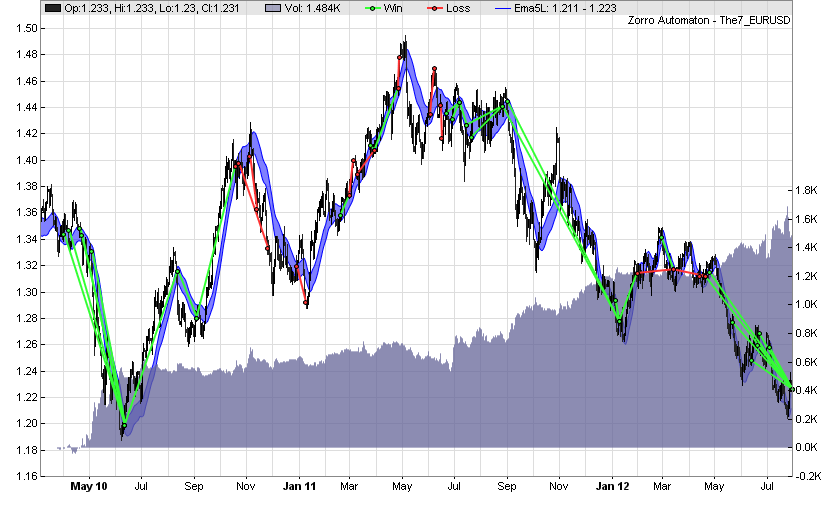

I just found this simple strategy on another forum, posted by someone with the name "The7". With some small modifications it was quite successful in a WFO test and gets > 7000 pips annual profit:

function run()

{

set(TESTNOW|PLOTNOW|PARAMETERS);

NumWFOCycles = 8;

BarPeriod = 1440;

while(asset(loop("EUR/USD","AUD/USD","USD/CAD")))

{

var Period = optimize(5,3,15);

var EMA5H = LowPass(series(priceHigh()),3*Period);

var EMA5L = LowPass(series(priceLow()),3*Period);

Stop = (HH(2) - LL(2)) * optimize(1,0.5,5);

if(priceOpen() > EMA5H && priceClose() < EMA5H && priceLow() > EMA5L)

enterShort();

else if(priceOpen() < EMA5L && priceClose() > EMA5L && priceHigh() < EMA5H)

enterLong();

}

}

The performance is quite remarkable for such a simple system. Here's the equity curve on a microlot account:

|

|

|

Re: The7 strategy

[Re: jcl]

#408451

Re: The7 strategy

[Re: jcl]

#408451

10/01/12 15:00

10/01/12 15:00

|

liftoff

Unregistered

|

liftoff

Unregistered

|

I hope Zorro 1.01 will come with forex only versions of Z1 and Z2 so we can test them properly on micro-accounts

|

|

|

Re: The7 strategy

[Re: ]

#408594

Re: The7 strategy

[Re: ]

#408594

10/04/12 10:47

10/04/12 10:47

|

Joined: Sep 2012

Posts: 99

TankWolf

Junior Member

|

Junior Member

Joined: Sep 2012

Posts: 99

|

function run()

{

set(TESTNOW|PLOTNOW|PARAMETERS);

NumWFOCycles = 8;

BarPeriod = 1440;

while(asset(loop("EUR/USD","AUD/USD","USD/CHF")))

{

var Period = optimize(5,3,15);

var EMA5H = LowPass(series(priceHigh()),3*Period);

var EMA5L = LowPass(series(priceLow()),3*Period);

Stop = (HH(2) - LL(2)) * optimize(1,0.5,5);

if(priceOpen() > EMA5H && priceClose() < EMA5H && priceLow() > EMA5L)

enterShort();

else if(priceOpen() < EMA5L && priceClose() > EMA5L && priceHigh() < EMA5H)

enterLong();

}

}

Annual return 471%

Profit factor 2.69 (PRR 2.08)

Sharpe ratio 1.53

Kelly criterion 0.51

OptimalF .082

Ulcer index 7%

Prediction error 44%

Change USD/CAD to USD/CHF and the results get even better. jcl I was wondering if we could do another example of setting up the optimal margin and lots on this because I seem to be having alot of trouble getting it to work because in this example we are only using one strategy instead of multiple as like in Workshop 6_2. One last thing is it possible to set the lots so they increase depending on account size. Say for an random example you want to risk 3% of your current balance on every new trade which sets 30 pip stops. Starting with say 1,000 capital I would normally work out ((Capital/100*Risk%)/Stop) = $ per contract ((1000/100*3)/30 = $1.00 per contract = 0.1 lot. OR

|

|

|

|