Posted By: jcl

Z4 and Z5 - newest info - 07/28/14 07:39

Z4 and Z5 users have certainly noticed that the systems made almost no trades in the last time. We're seeing here what happens when large trade institutions exploit an inefficiency:

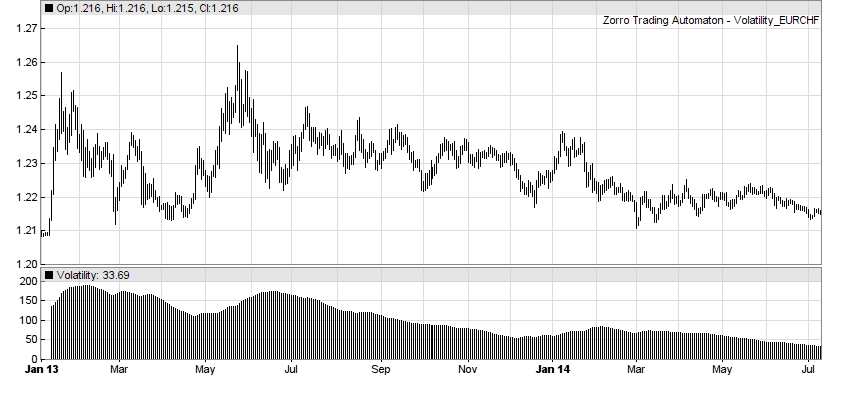

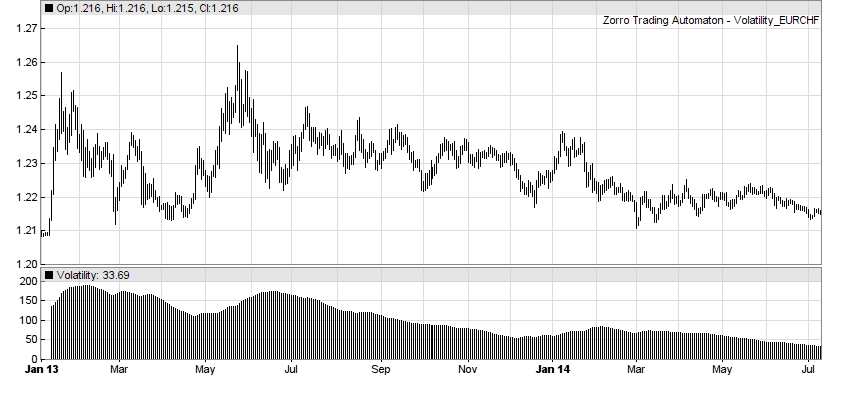

Algorithmic traders started exploiting the CHF around January 2013. It was a very obvious and easy to use ineffectivity, so more and more jumped onto the bandwagon, by mid-2013 also banks and trading firms with very high trade volumes. Consequently we can see how the native CHF volatility went down step by step over the next year. This made it harder and harder to squeeze profit out of it. In such a situation, volatility peaks are only caused by external events, such as the last one in January 2014. Due to the low volatility the system now requires different algorithms. Mere grid trading won't do anymore. The next Zorro update will contain modified Z4/Z5 systems that still generate profit even with extremely low volatility.

Algorithmic traders started exploiting the CHF around January 2013. It was a very obvious and easy to use ineffectivity, so more and more jumped onto the bandwagon, by mid-2013 also banks and trading firms with very high trade volumes. Consequently we can see how the native CHF volatility went down step by step over the next year. This made it harder and harder to squeeze profit out of it. In such a situation, volatility peaks are only caused by external events, such as the last one in January 2014. Due to the low volatility the system now requires different algorithms. Mere grid trading won't do anymore. The next Zorro update will contain modified Z4/Z5 systems that still generate profit even with extremely low volatility.