Posted By: GreenBoat

How much is enough? (annual return when testing the strategy) - 07/20/17 17:45

I have a few strategies which look promising.

However, I am not sure for how high return per year am I looking for?

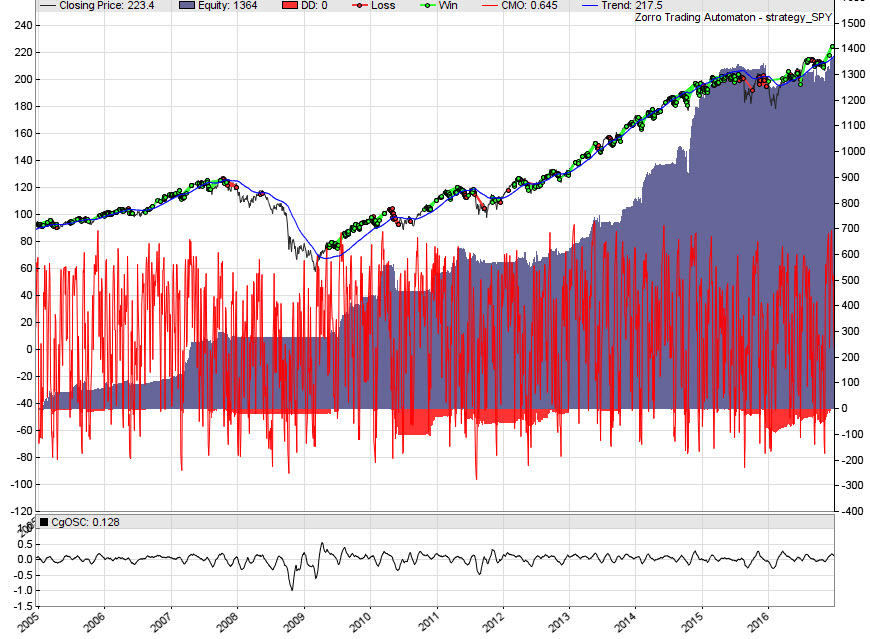

For example on the image below is one of my strategies.

Zorro tells me that there is 12% annual return and 1,11 sharpe ratio. 64% of trades are profitable.

Is it enough for continuing with the development? (adding SL, PT, money management, etc.)

Or should it be more? What are the parameters allowing continuing with the development?

However, I am not sure for how high return per year am I looking for?

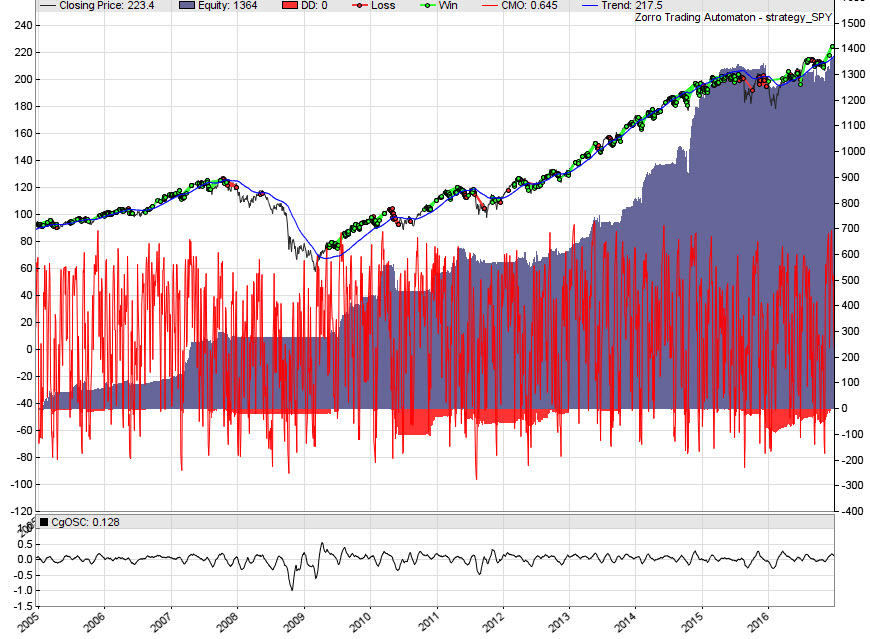

For example on the image below is one of my strategies.

Zorro tells me that there is 12% annual return and 1,11 sharpe ratio. 64% of trades are profitable.

Is it enough for continuing with the development? (adding SL, PT, money management, etc.)

Or should it be more? What are the parameters allowing continuing with the development?