Posted By: jcl

The7 strategy - 09/30/12 16:04

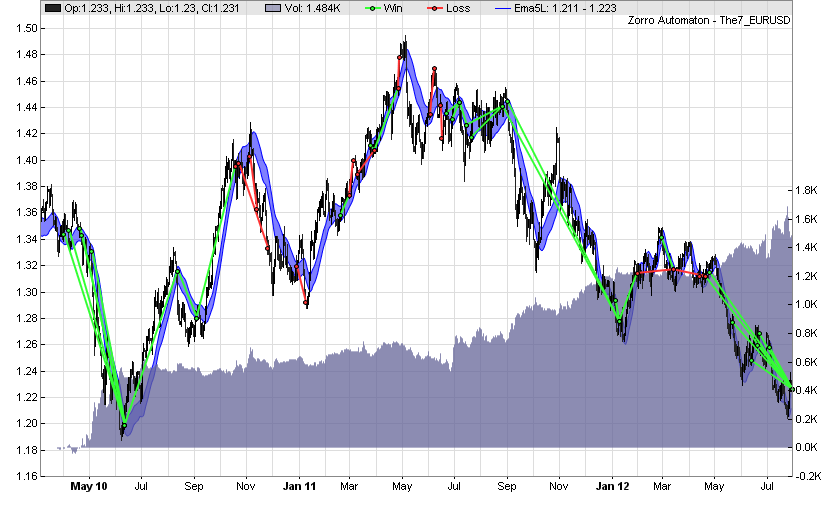

I just found this simple strategy on another forum, posted by someone with the name "The7". With some small modifications it was quite successful in a WFO test and gets > 7000 pips annual profit:

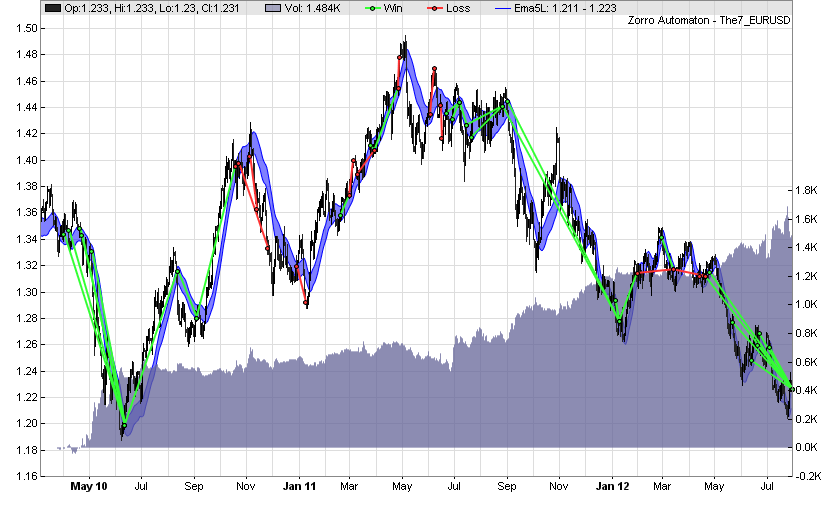

The performance is quite remarkable for such a simple system. Here's the equity curve on a microlot account:

Code:

function run()

{

set(TESTNOW|PLOTNOW|PARAMETERS);

NumWFOCycles = 8;

BarPeriod = 1440;

while(asset(loop("EUR/USD","AUD/USD","USD/CAD")))

{

var Period = optimize(5,3,15);

var EMA5H = LowPass(series(priceHigh()),3*Period);

var EMA5L = LowPass(series(priceLow()),3*Period);

Stop = (HH(2) - LL(2)) * optimize(1,0.5,5);

if(priceOpen() > EMA5H && priceClose() < EMA5H && priceLow() > EMA5L)

enterShort();

else if(priceOpen() < EMA5L && priceClose() > EMA5L && priceHigh() < EMA5H)

enterLong();

}

}

The performance is quite remarkable for such a simple system. Here's the equity curve on a microlot account: