Posted By: jcl

Huck's trend catcher - 09/05/12 12:08

This simple strategy was suggested on another forum:

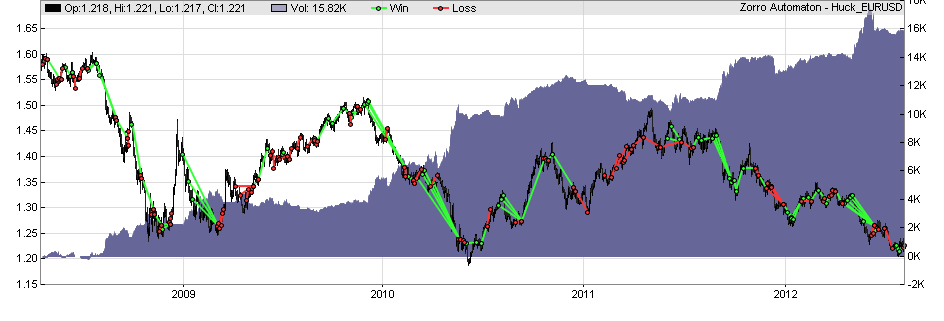

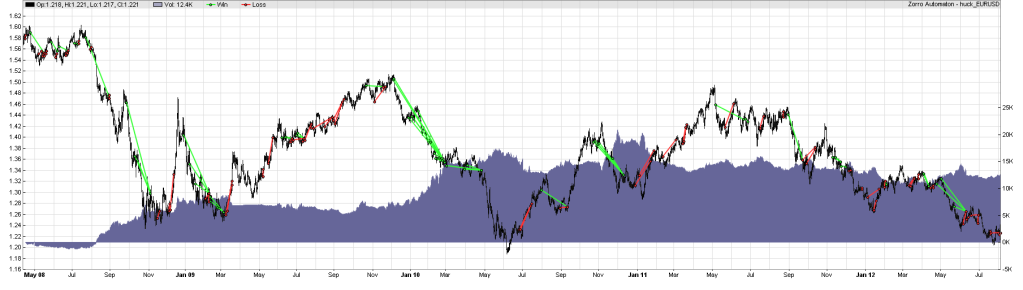

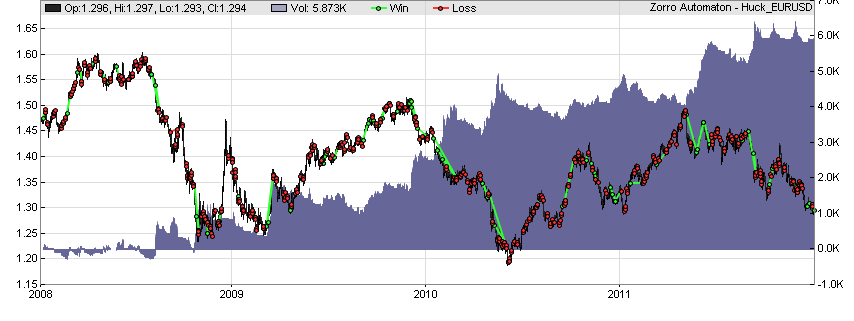

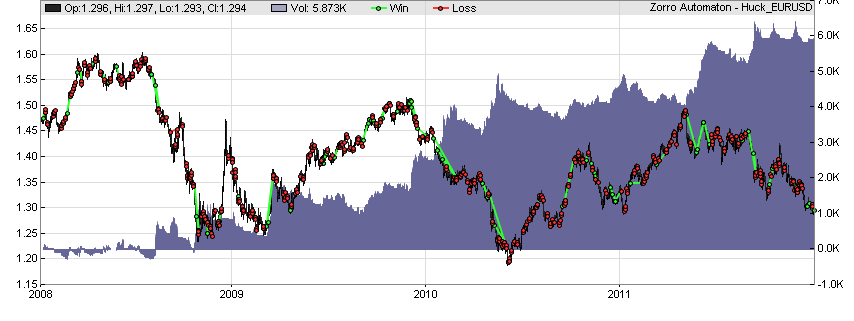

The equity curve:

Feel free to improve...

Code:

function run()

{

var *Price = series(price());

var *LP5 = series(LowPass(Price,5));

var *LP10 = series(LowPass(Price,10));

var *RSI10 = series(RSI(Price,10));

Stop = 50*PIP;

if(crossOver(LP5,LP10) && crossOver(RSI10,50))

enterLong();

else if(crossUnder(LP5,LP10) && crossUnder(RSI10,50))

enterShort();

}

The equity curve:

Feel free to improve...